tPR Annual Funding Statement 2025

Introduction

The Pensions Regulator (tPR) published its 2025 Annual Funding Statement on 29 April 2025. The statement is for trustees and sponsors of Defined Benefit (DB) pension schemes and is particularly aimed at schemes with actuarial valuations between 22 September 2024 and 21 September 2025 (‘Tranche 24/25’). Whilst it is targeted at those, this year’s Statement is relevant for all DB schemes as it provides further information around the new DB Funding Code of Practice.

Some of the key points are summarised below:

General considerations

Endgame planning

In light of defined benefit (DB) schemes having seen notable improvements in funding and shifting their focus from deficit repair to endgame planning, tPR will publish additional guidance in early summer to support trustees with this process.

Changing economic landscape

Trustees should recognise the current uncertainty within the economic climate (including, but not limited to, trade, geopolitical, artificial intelligence and energy transition) and how this may affect investments and their sponsor’s covenant. Trustees should ensure that short-term liquidity and cashflow requirements can be met. Where these elements could have a material impact on the sponsor covenant, trustees should consider whether the level of risk that the scheme is running remains supportable.

Resilience of the Scheme to shocks

tPR encourage trustees to carry out regular stress tests on their investment strategy to test how robust the LDI strategy is. They also ask trustees to be aware of the concentration risk associated with assets earmarked for sale during stress events.

Surplus Release

There is growing interest in the treatment of scheme funding surpluses and the potential for surplus release. Further clarity is anticipated in the forthcoming Pensions Bill, where the government is expected to set out its legislative approach on this matter. tPR recommends in the interim that trustees start considering how any requests from the sponsor for a release of surplus would be approached.

DB Funding Code - Regulation of triennial valuations

tPR continue to emphasise that they will be proportionate when carrying out their risk assessment of triennial valuations under the new DB Funding Code. In particular where schemes meet the tolerable risk defined under Fast Track then less evidence and explanation will be required in the new Statement of Strategy document. Where schemes go through the bespoke option then more evidence will need to be submitted and tPR will adopt a risk-based, outcome-focused approach to determine which schemes are then engaged with further to understand the approach taken. It is recognised that the Fast Track approach will not be the right approach for all schemes.

DB Funding Code - clarifications

- tPR have taken the opportunity with their annual statement to provide clarifications on the new DB Funding regime. Notable points include, but are not limited to:

- Before starting a covenant assessment, trustees should work with their adviser to understand the current level of reliance on the sponsor. A lighter touch approach to assessing the covenant may be more appropriate where there is a lower reliance on the covenant. A Fast Track scheme is still expected to carry out a proportionate covenant assessment.

- The statement of strategy allows flexibility for schemes to accurately describe their long-term objective. Intentions to buy-out should only be declared if the commitment to achieve buyout is clear. There is no legal obligation to meet the long-term objective within a specific timeframe although the low dependency target does need to be met by the scheme’s relevant date.

- A formal supportable risk assessment formula will not be published. This recognises the need for schemes to approach the assessment based on the specific circumstances of the scheme and employer.

- tPR’s new digital service 'Submit a scheme valuation' will launch in Spring 2025, allowing trustees to submit their valuation and statement of strategy.

Funding strategies

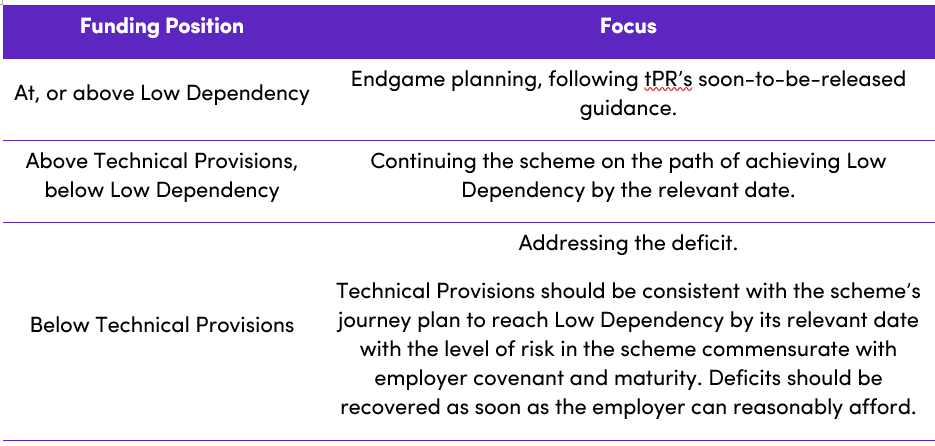

tPR expects that schemes should have the following focus depending on which situation they are in.

The 2025 Annual Funding Statement can be found here. If you would like any further information in relation to the above, please get in touch with your usual Quantum Advisory contact or email us at info@qallp.co.uk.